Printable Sales Tax Table

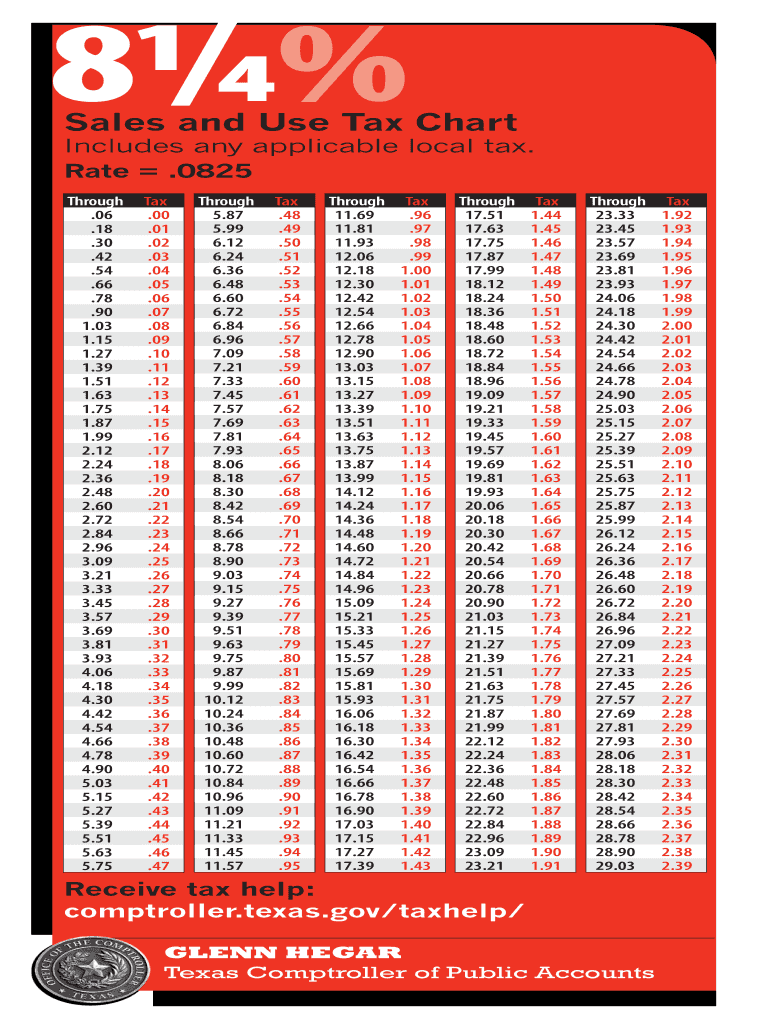

Printable Sales Tax Table - Many states allow local governments to charge a local sales tax in addition to the statewide. This chart can be used to easily calculate 9% sales taxes. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. There are a total of 514 local tax jurisdictions across the state, collecting. Bookmark this page or print off a chart to have quick access to state sales tax rates, sales tax holiday. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. Tax rate tables delivered via email monthly to keep you up to date on changing rates. Listed below by county are the total (4.75% state rate plus applicable local and transit rates) sales and use tax rates.note: This chart can be used to easily calculate illinois sales taxes. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. These rates do not include any prepared meal taxes imposed and. Download sales tax rate tables for any state for free. Listed below by county are the total (4.75% state rate plus applicable local and transit rates) sales and use tax rates.note: In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. 7% sales and use tax chart that is free to print and use. The following taxes are affected:. You can print a 10.25% sales tax. This is a printable california sales tax table, by sale amount, which can be customized by sales tax rate. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. See the 2024 tax tables (for money you earned in 2024). Effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators, also defined in section 1 of. Find the 2025 tax rates (for money you earn in 2025). In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. There are a total of 514 local tax jurisdictions across the state, collecting. See current federal tax brackets and rates based on your income and filing status. Effective january 1, 2021, remote retailers, as defined in section 1. Many states allow local governments to charge a local sales tax in addition to the statewide. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. This table, and the map above, display the base statewide sales tax for each of the fifty states. Retail sales taxes are. This chart can be used to easily calculate 9% sales taxes. This is a printable california sales tax table, by sale amount, which can be customized by sales tax rate. Download sales tax rate tables for any state for free. The following taxes are affected:. Tax rate tables delivered via email monthly to keep you up to date on changing. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. There are a total of 514 local tax jurisdictions across the state, collecting. This chart can be used to easily calculate illinois sales taxes. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. This chart can be used to easily calculate california sales taxes. See the 2024 tax tables (for money you earned in 2024). This is a printable 9% sales tax table, by sale amount, which can be customized by. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. This table, and the map above, display the base statewide sales tax for each of the fifty states. The following taxes are affected:. This chart can be used to easily calculate illinois sales taxes. This is a printable. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. See current federal tax brackets and rates based on your income and filing status. This chart can be used. Many states allow local governments to charge a local sales tax in addition to the statewide. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. Bookmark this page or print off a chart to have quick access to state. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a. Download sales tax rate tables for any state for free. This chart can be used to easily calculate california sales taxes. The following taxes are affected:. This table, and the map above, display the base statewide sales tax for each of the fifty states. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. Many states allow local governments to charge a local sales tax in addition to the statewide. This chart can be used to easily calculate illinois sales taxes. These rates do not include any prepared meal taxes imposed and. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. Tax rate tables delivered via email monthly to keep you up to date on changing rates. See current federal tax brackets and rates based on your income and filing status. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. These charts can serve as handy references in your day to day sales and use tax work. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. Bookmark this page or print off a chart to have quick access to state sales tax rates, sales tax holiday.Sales taxes in the United States Wikipedia

Where to Find and How to Read 1040 Tax Tables

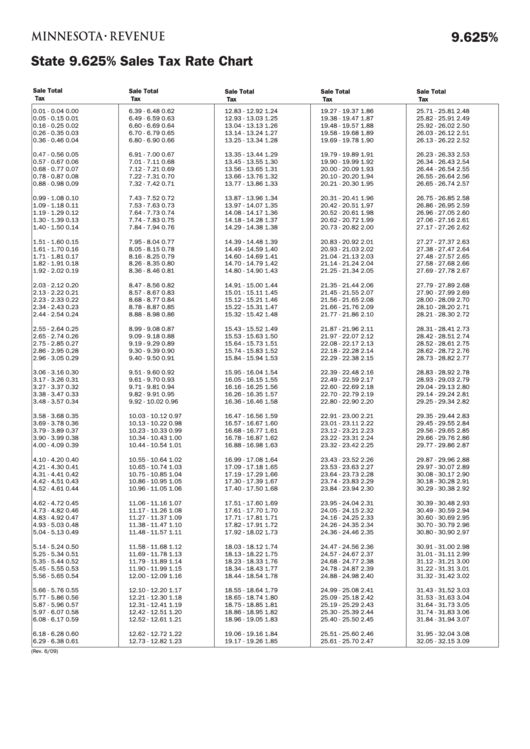

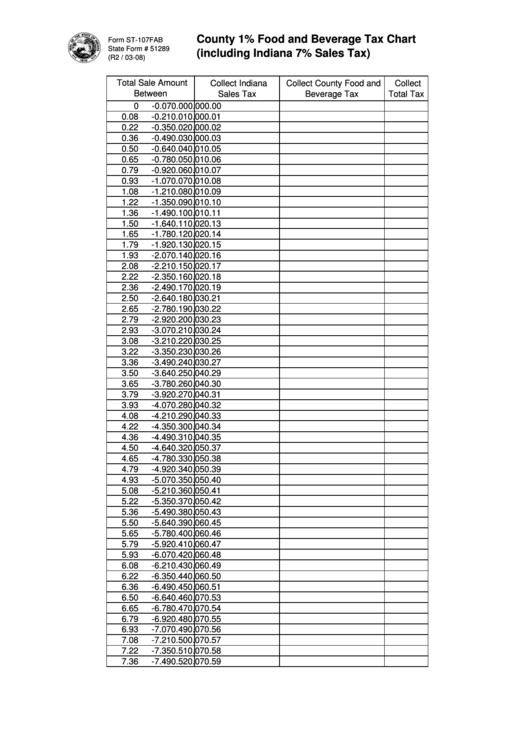

Printable Sales Tax Chart

7 25 Sales Tax Chart Printable Printable Word Searches

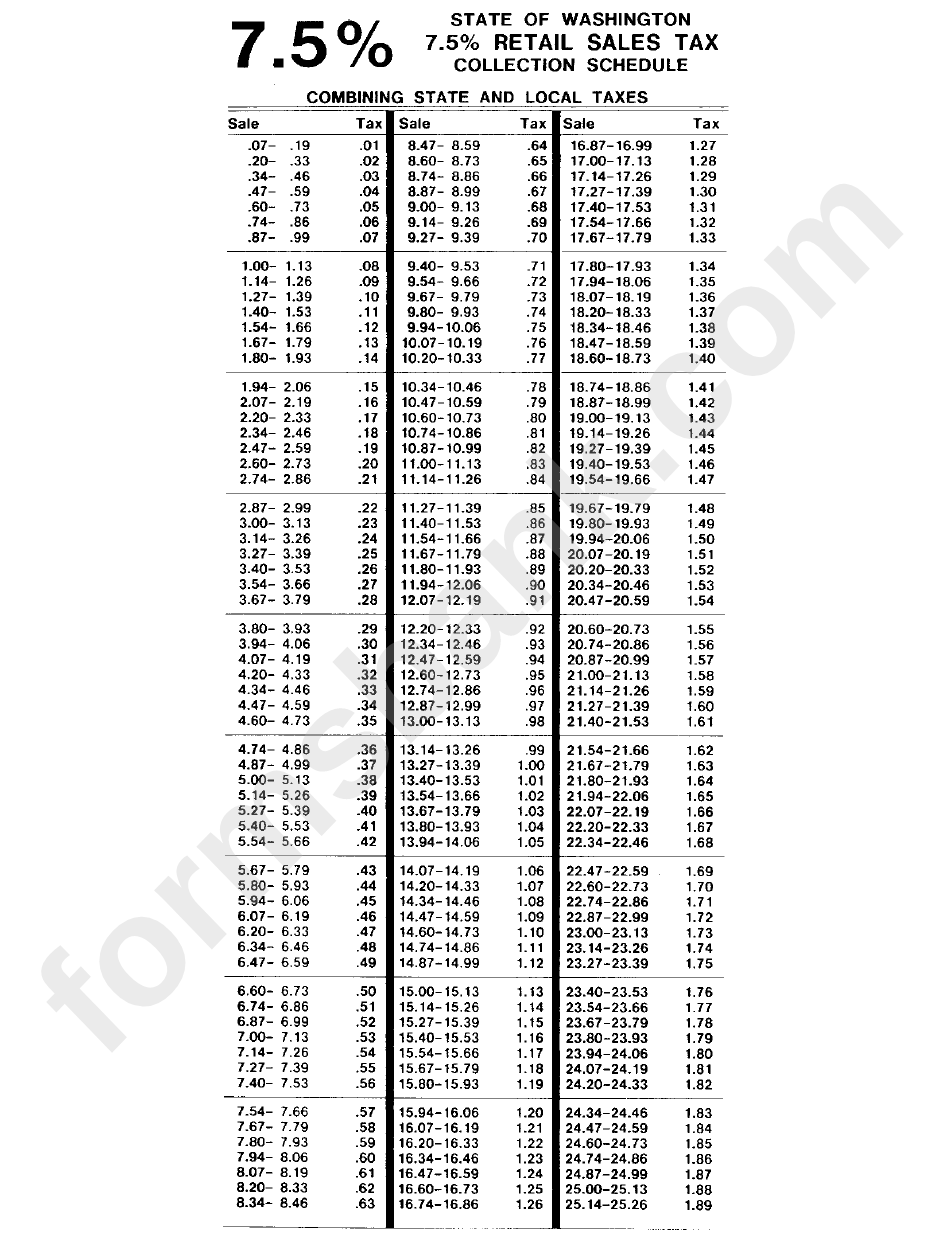

State Of Washington 7.5 Retail Sales Tax Collection Shcedule printable

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

Printable Sales Tax Chart

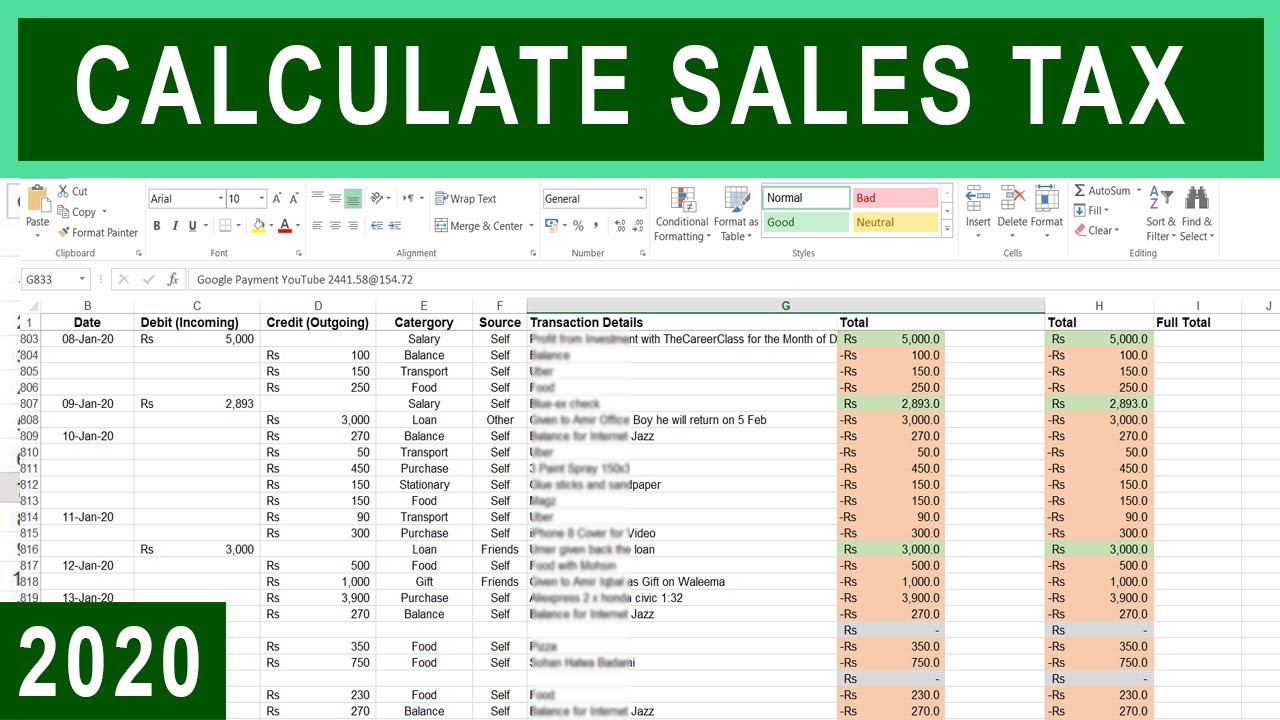

How to Calculate Sales Tax in Excel Tutorial YouTube

Printable Sales Tax Chart

Printable Sales Tax Chart

This Chart Can Be Used To Easily Calculate Illinois Sales Taxes.

This Is A Printable California Sales Tax Table, By Sale Amount, Which Can Be Customized By Sales Tax Rate.

This Chart Can Be Used To Easily Calculate 9% Sales Taxes.

Listed Below By County Are The Total (4.75% State Rate Plus Applicable Local And Transit Rates) Sales And Use Tax Rates.note:

Related Post:

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)