1099Nec Printable

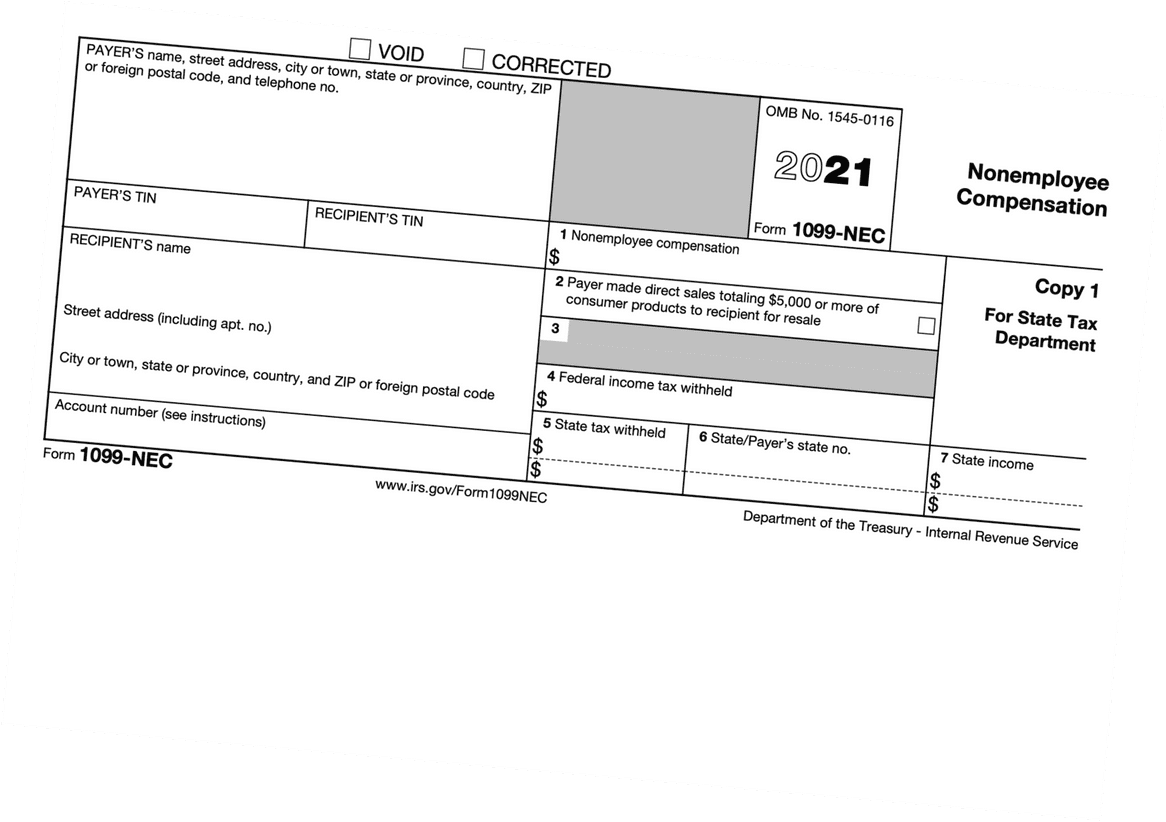

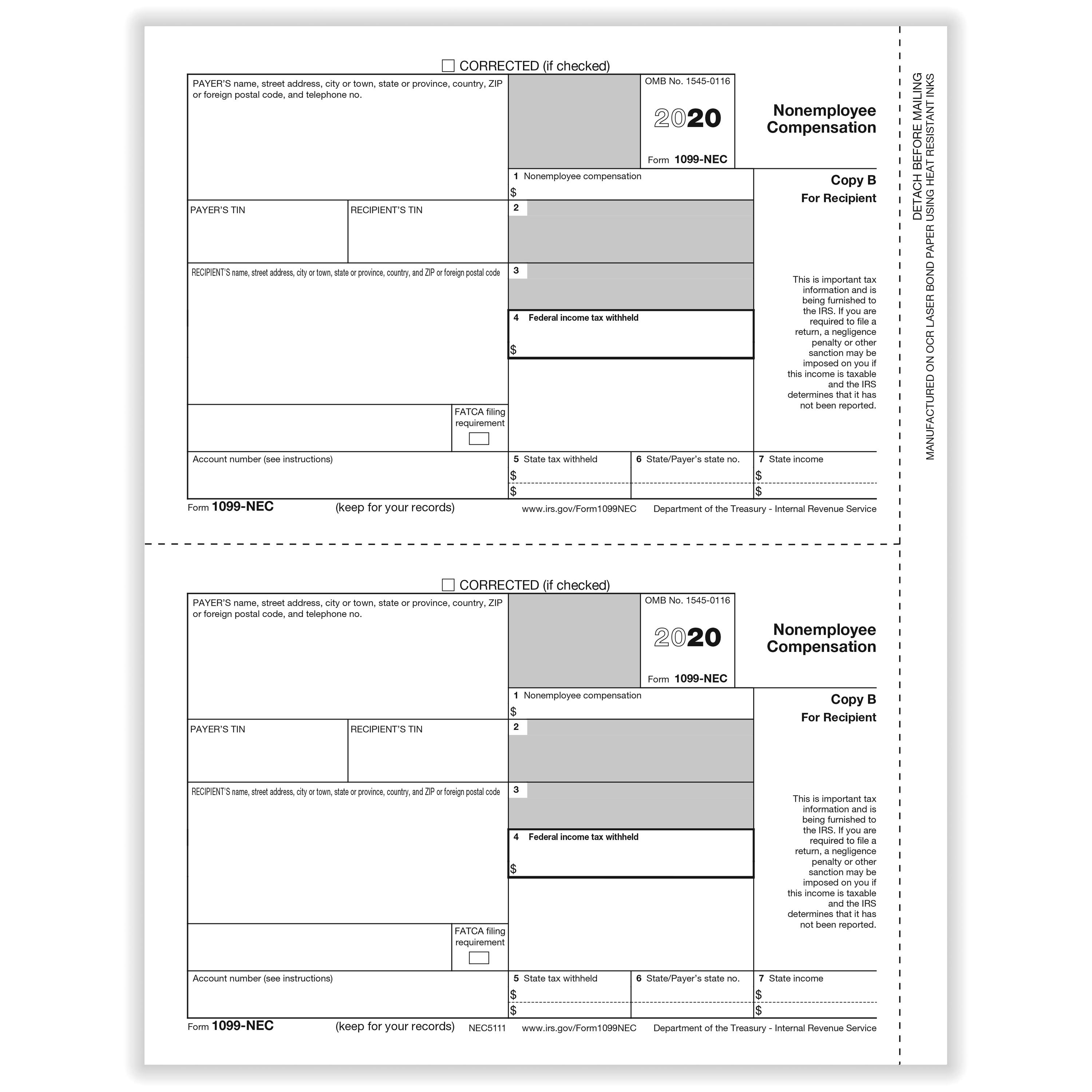

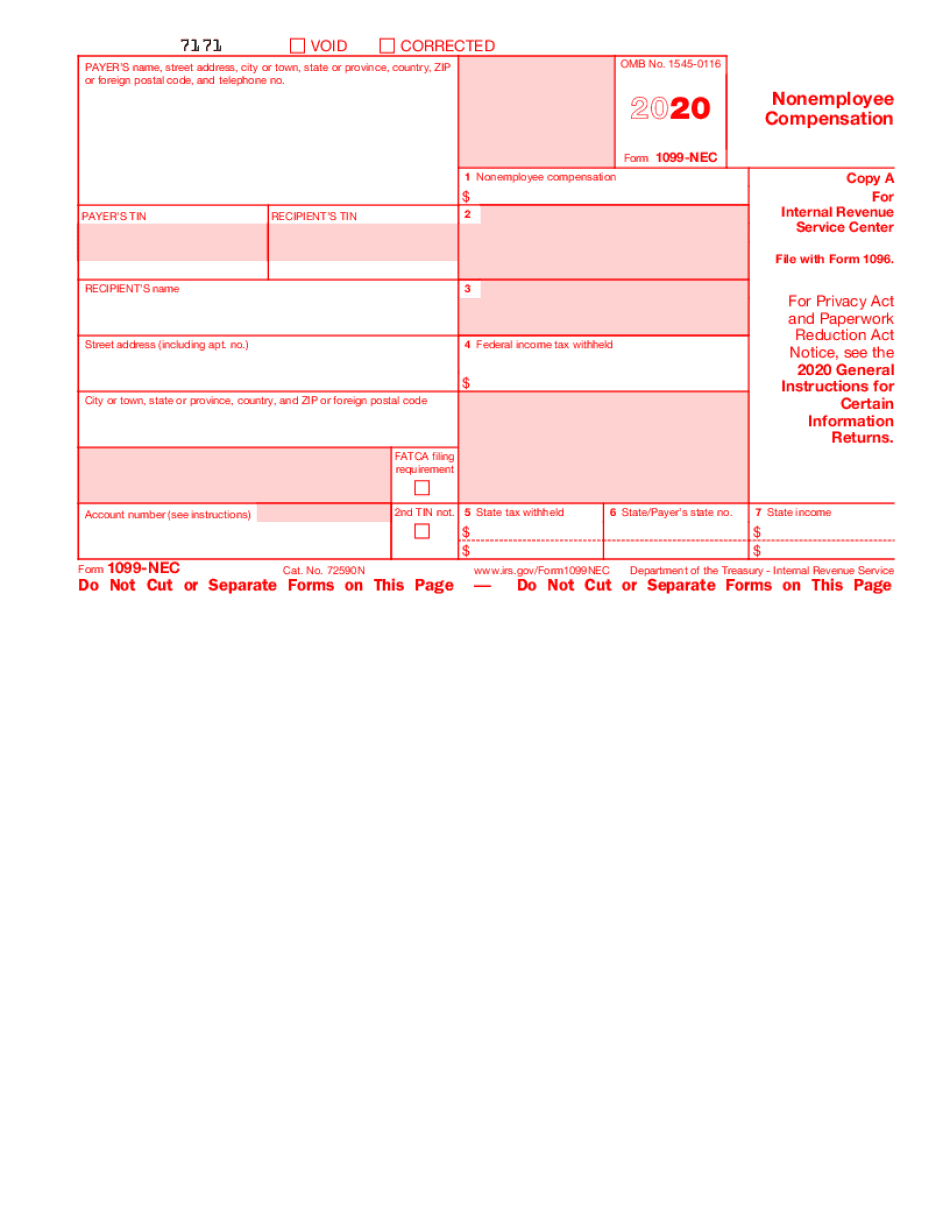

1099Nec Printable - You can complete these copies online for furnishing statements to recipients and for retaining in your own files. This ensures compliance with irs reporting requirements. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris taxpayer portal is available to any business of any size. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. It’s also used for reporting payments made for work performed outside of an employment context. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. These “continuous use” forms no longer include the tax year. You can't print the irs copy (copy a) on plain paper; Fill out the nonemployee compensation online and print it out for free. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Please note that copy b and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. Fill out the nonemployee compensation online and print it out for free. It helps businesses accurately disclose payments made to freelancers or contractors, ensuring compliance with irs requirements. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. It’s also used for reporting payments made for work performed outside of an employment context. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Nonemployee compensation if, over the tax year, you get $600 worth of fees, commissions, prizes, benefits, and awards for nonemployee services performed, you’ll probably be issued a. Quickbooks will print the year on the forms for you. Please note that copy b and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. The red form you can download from the irs is not to be submitted to the irs. Fill out the nonemployee compensation online and print it out. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. The red form you can download from the irs is not to be submitted to the irs. Please note that copy b. There are 20 active types of. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Fill in, efile, print, or download forms in pdf format. It's secure, reduces the need for paper forms and requires no special software. You can complete these copies online for furnishing statements to recipients and for. Nonemployee compensation if, over the tax year, you get $600 worth of fees, commissions, prizes, benefits, and awards for nonemployee services performed, you’ll probably be issued a. You can't print the irs copy (copy a) on plain paper; Please note that copy b and other copies of this form, which appear in black, may be downloaded and printed and used. Nonemployee compensation if, over the tax year, you get $600 worth of fees, commissions, prizes, benefits, and awards for nonemployee services performed, you’ll probably be issued a. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more.. Read the instructions carefully here. Fill in, efile, print, or download forms in pdf format. The red form you can download from the irs is not to be submitted to the irs. Fill out the nonemployee compensation online and print it out for free. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. The red form you can download from the irs is not to be submitted to the irs. Irs. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. These “continuous use” forms no longer include the tax year. It’s also used for reporting payments made for. Read the instructions carefully here. This ensures compliance with irs reporting requirements. Nonemployee compensation if, over the tax year, you get $600 worth of fees, commissions, prizes, benefits, and awards for nonemployee services performed, you’ll probably be issued a. These “continuous use” forms no longer include the tax year. See part o in the current general instructions for certain information. Quickbooks will print the year on the forms for you. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. This ensures compliance with irs reporting requirements. Read the instructions carefully here. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Please note that copy b and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Fill out the nonemployee compensation online and print it out for free. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties. It's secure, reduces the need for paper forms and requires no special software. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Fill in, efile, print, or download forms in pdf format. It helps businesses accurately disclose payments made to freelancers or contractors, ensuring compliance with irs requirements. There are 20 active types of. It’s also used for reporting payments made for work performed outside of an employment context. The red form you can download from the irs is not to be submitted to the irs. Copies b, c, and 1 can be printed on regular paper.2020 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

Free Printable 1099NEC File Online 1099FormTemplate

Printable Fillable 1099 Nec

Form 1099 Nec Printable Blank PDF Online

Printable Irs Form 1099 Nec

Printable Irs Form 1099 Nec

How to File Your Taxes if You Received a Form 1099NEC

Free 1099 Nec Printable

1099Nec Word Template Free See Your Tax Return Instructions For Where

Tax Form 1099NEC > Printable IRS 1099NEC Form for 2023 & Free

Quickbooks Will Print The Year On The Forms For You.

You Can't Print The Irs Copy (Copy A) On Plain Paper;

These “Continuous Use” Forms No Longer Include The Tax Year.

Business Taxpayers Can File Electronically Any Form 1099 Series Information Returns For Free With The Irs Information Returns Intake System.the Iris Taxpayer Portal Is Available To Any Business Of Any Size.

Related Post:

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)